The given balance reflects the net amount available after credits and debits. In most businesses, two or three-column cash books (with a bank column) are used to record any transactions made through the bank account. When you do a bank reconciliation, you first find the bank transactions that are responsible for your books and your bank account being out of sync. If you use the accrual system of accounting, you might “debit” your cash account when you finish a project and the client says “the cheque is going in the mail today, I promise! Then when you do your bank reconciliation a month later, you realize that cheque never came, and the money isn’t in your books (even though your bookkeeping shows you got paid). Reconciling your bank statements lets you see the relationship between when money enters your business and when it enters your bank account, and plan how you collect and spend money accordingly.

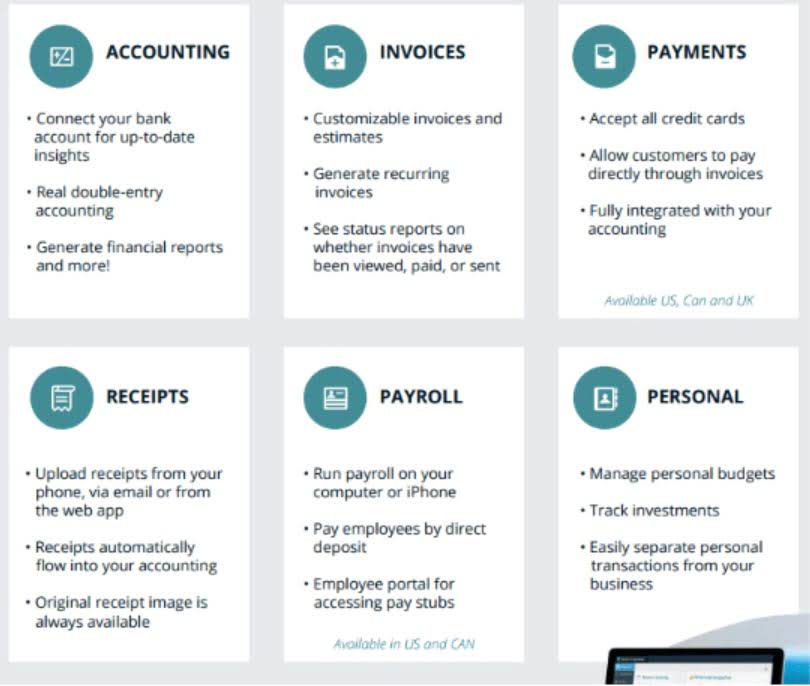

Our Services

Over time, you could better understand your spending habits, prevent overdraft fees and detect fraud or errors. A money market account combines the features or both a savings and checking account. You can withdraw and deposit funds from this account and write checks as well as gain interest. If you want to keep all of your funds in one, flexible account where you have access to balance details, can use your card at ATM’s, and additional services, a money market account may be a good fit.

Tips For Maintaining Your Check Register & Positive Banking Record

You’ll want to start with your checking account register from step one, whether that’s a physical booklet, spreadsheet or other app. People think balancing their checking account book balance vs bank balance is no longer necessary in the digital age. However, balancing a checking account is important because it helps you stay on top of your finances and could avoid costly mistakes.

Cash Book and Bank Statement

Regularly reviewing and cross-checking entries can help mitigate these errors. A checking account is a type of bank account designed for day-to-day financial transactions, offering easy access to your money through checks, debit cards, and online transfers. It’s the primary account most people use to pay bills, make purchases, and manage their finances.

You need an ongoing record of deposits, withdrawals, checks written and any fees or interest earned. You’ll use this record to continue the process of balancing your checkbook. Balancing a checking account begins with tracking your account activity. Whether you use paper https://www.bookstime.com/articles/outstanding-checks or technology, you’ll need a record of your activity. This record is sometimes referred to as a register, and you’ll compare it against the bank’s records of your account activity. The “balancing” aspect is reconciling the two records and confirming your account balance.

Bank Statement Entries May Not Appear in Cash Book

You can also get tips for using your check register and keeping an account in good standing. Every time cash, checks, money orders, or postal orders (or anything else) are deposited in the bank, the cash book (bank column) is debited. That’s to say, an entry is made in the bank column on the debit side of the cash book. The opposite is true when the total credit exceeds total debits, the account indicates a credit balance.

- As a result, the interest earned would not be reflected in the book balance until the interest has been credited and the bank account reconciliation has been performed.

- Therefore, until the interest is deposited and the bank accounts have been totaled, the interest created will not appear in the book balance.

- Discrepancies can bring serious issues like wrong financial statements and possible legal problems.

- Accurate financial records enable businesses to forecast future cash flows well, make strategic investments, and plan for possibilities.

- More specifically, you’re looking to see if the “ending balance” of these two accounts are the same over a particular period (say, for the month of February).

- If you deposited a check, but it hasn’t been processed, your book balance will be higher than your bank balance.

If your register balance matches the adjusted statement balance, consider your account balanced! When there are errors or issues within your account, you may need to discuss the next steps with your bank. The source of bank statement entries is cheques deposited by customers, payments made to suppliers by issuing a draft or check. When the bank pays out cash against that cheque, it records the payment on the debit column of his statement of account.

Bank reconciliations are like a fail-safe for making sure your accounts receivable never get out of control. And if you’re consistently seeing a discrepancy in accounts receivable between your balance sheet and your bank, you know you have a deeper issue to fix. If there’s a discrepancy between your accounts and the bank’s records that you can’t explain any other way, it may be time to speak to someone at the bank.

- Bank deposit accounts, such as checking and savings, may be subject to approval.

- For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback.

- This method originated from a time when writing checks was the primary way of making payments out of your checking account.

- So it’s useful to establish good record-keeping habits now, including those below, to avoid complications in the future.

- Whether you use paper or technology, you’ll need a record of your activity.

By making this a regular practice, you’ll be better equipped to manage your money, avoid fees, and maintain financial peace of mind. With Chase for Business you’ll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and managing payroll. Choose from business checking, business credit cards, merchant services or visit our business resource center.